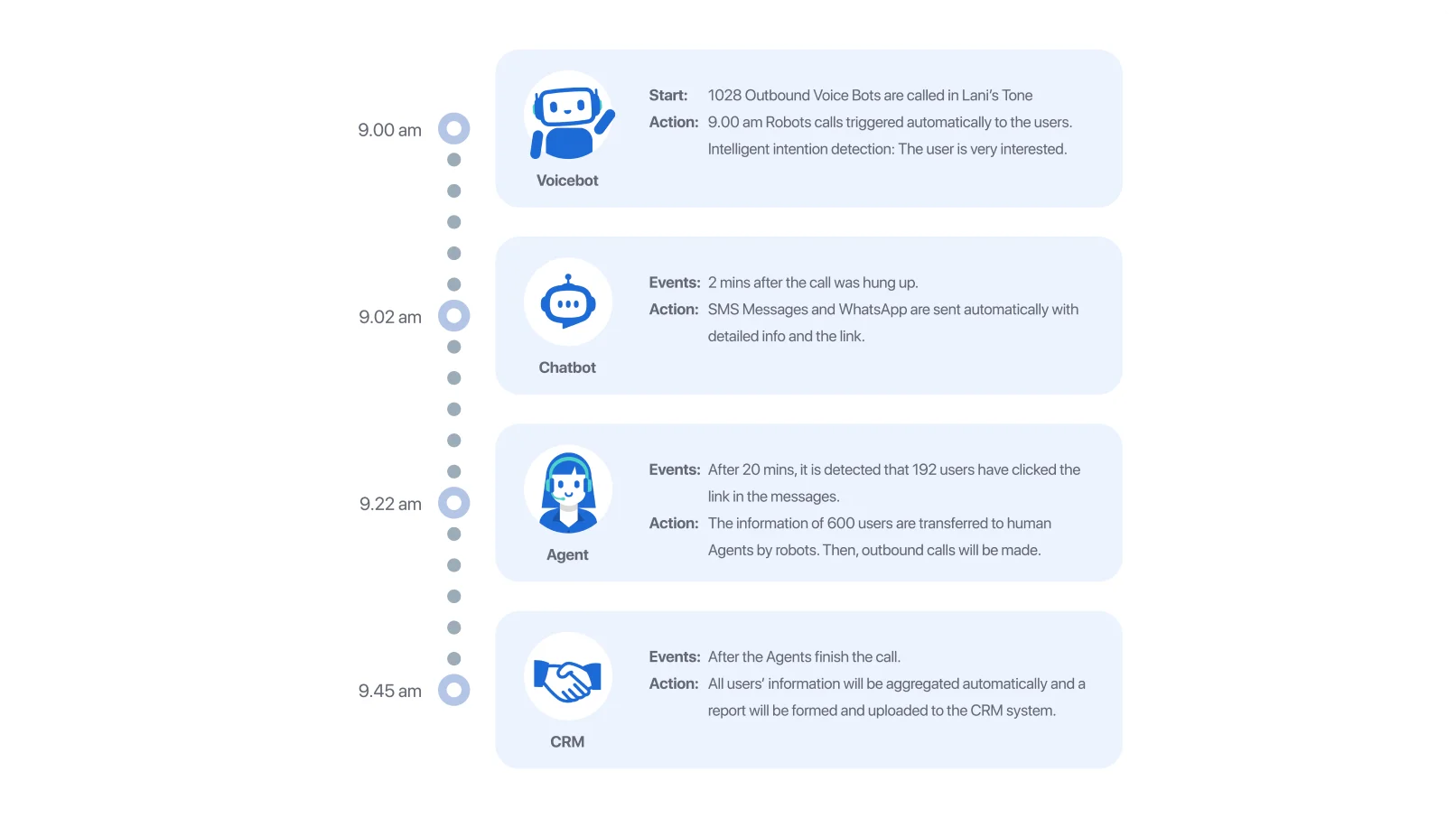

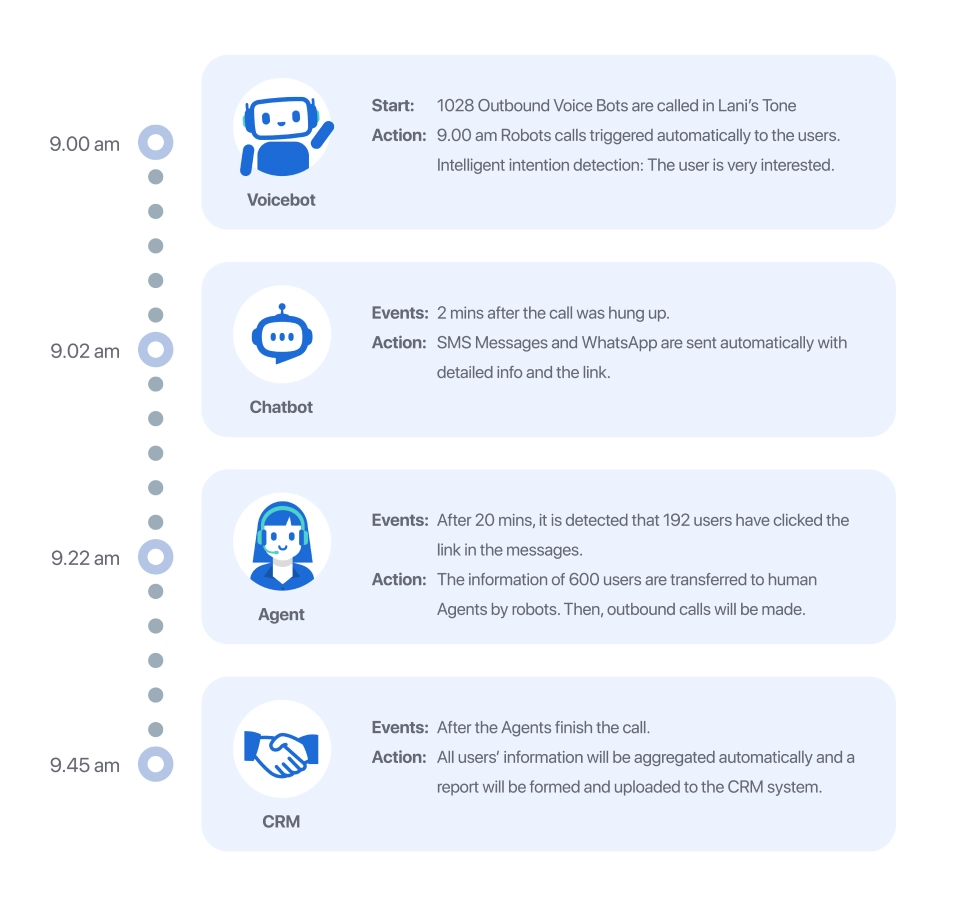

AI Voicebot

Automate outbound and inbound KYC verification calls with natural, human-like conversations. AI Rudder’s Voicebot confirms customer identity, validates information, collects missing data, and guides users through verification steps in real time, reducing manual workload, improving accuracy, and accelerating compliance processes at scale.

Learn More

AI Chatbot

Engage customers instantly across WhatsApp, web, and mobile apps to collect required verification data and guide them through complete KYC flows without human intervention. The chatbot validates information, flags inconsistencies in real time, and ensures secure, compliant, and frictionless digital onboarding.

Learn More

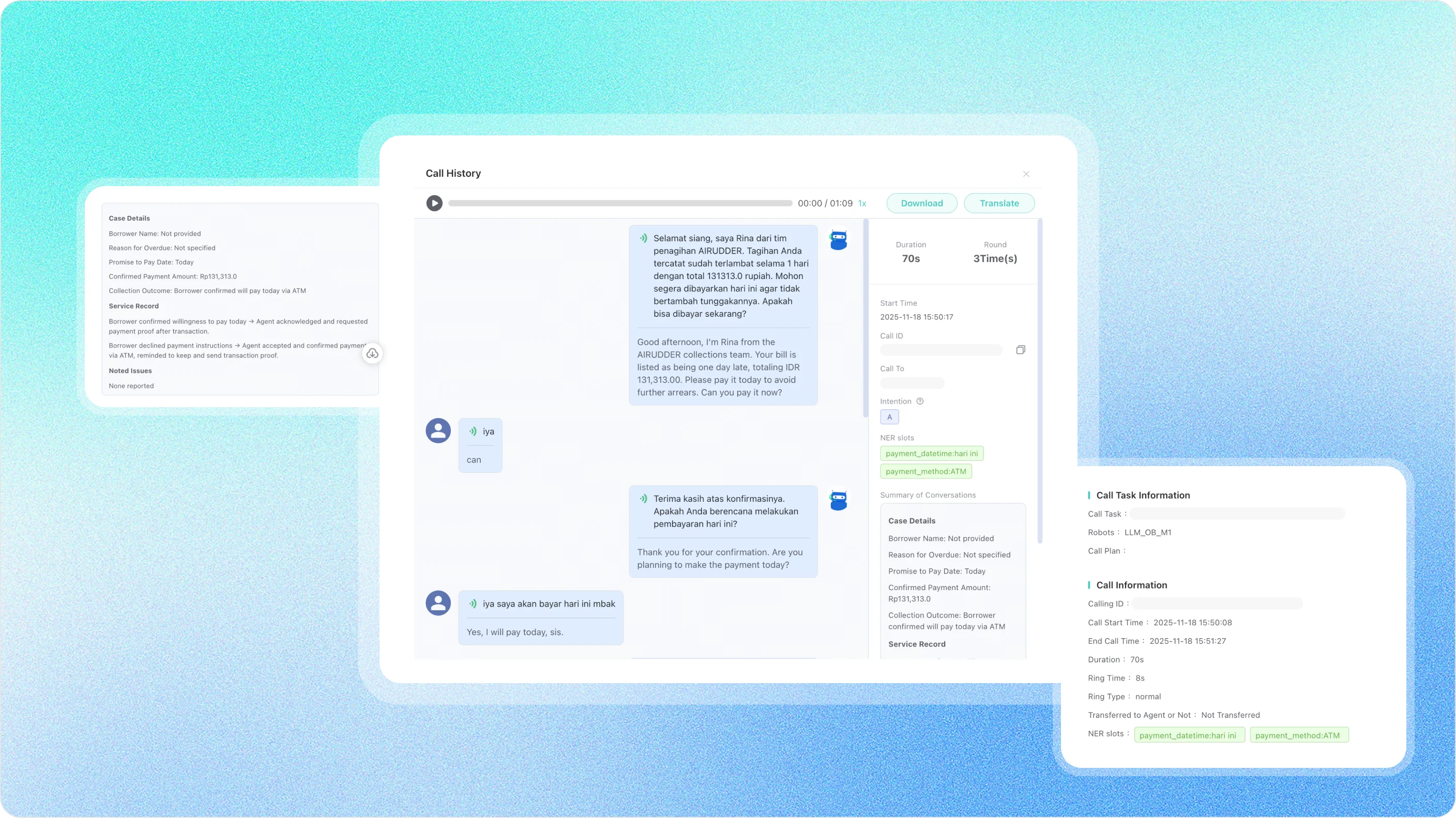

AI Contact Center

Centralize and automate your entire KYC and information-checking operation with omnichannel workflows, real-time agent assist, intelligent routing, and seamless bot-to-human escalation. AI Rudder’s contact center solution accelerates verification cycles, ensures compliance, reduces manual workload, and delivers consistent, secure KYC experiences across every customer touchpoint.

Learn More