Deliver Faster, Friendlier Insurance Experiences with AI

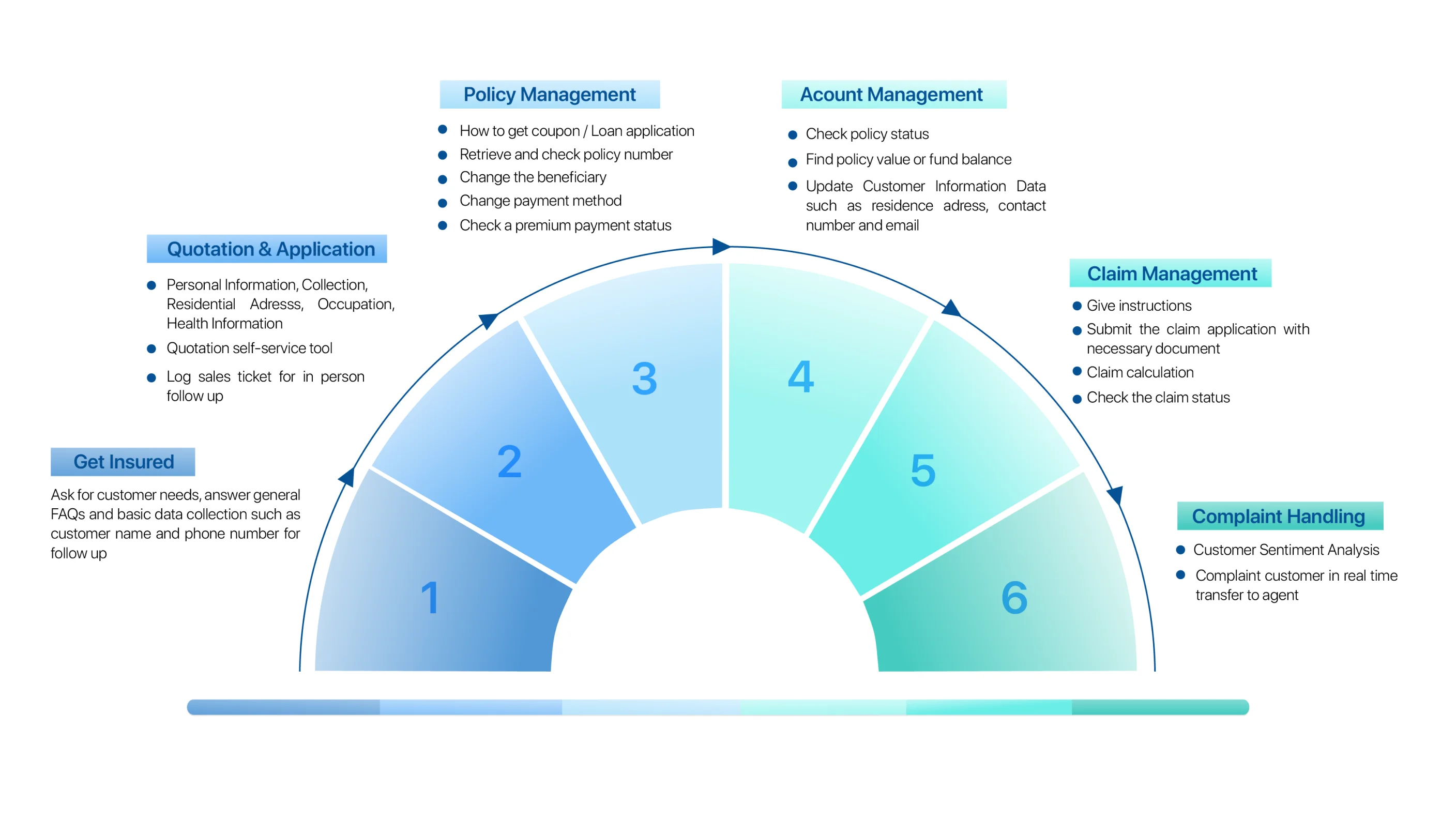

From claims processing to policy management, AI-powered conversations help insurers resolve issues quickly, improve customer satisfaction, and optimize efficiency.

Get a Demo

Why Insurance Companies Choose AI Rudder

How Our AI Transforms Insurance Industry

Redefine policyholder engagement without losing the personal connection

AI Voice Agent enables insurers to streamline customer communication across claims, policy management, and renewals through intelligent, human-like voice automation. Enhance responsiveness, improve customer satisfaction, and ensure data security, all while keeping operations efficient and compliant.

- Engage policyholders naturally with 24/7 conversational voice experiences that feel personal and responsive.

- Automate high-volume interactions such as claim status updates, premium reminders, and coverage inquiries to improve operational efficiency.

- Drive proactive customer follow-ups with AI agents that ensure timely engagement and smoother policyholder journeys.

- Maintain trust and compliance through enterprise-level security, encryption, and continuous monitoring safeguards.

Transform Insurance Conversations with Intelligent Automation

AI Chat Agent enables insurers to deliver fast, intelligent support across web, mobile, and messaging channels. Strengthen policyholder relationships, reduce response times, and boost operational efficiency while maintaining full compliance, privacy, and trust.

- Engage policyholders anytime, anywhere with personalized, conversational chat experiences across all digital channels.

- Automate high-volume workflows including claim submissions, policy inquiries, premium payments, and coverage updates to lighten agent workload.

- Protect customer data with enterprise-grade compliance frameworks, strong encryption, and audit-ready security controls.

Level up Insurance Service with an AI-Powered Contact Center

AI Rudder AI Contact Center (AICC) & Omnichannel brings together voice, chat, and digital channels into one intelligent platform designed for insurers. Empower agents, streamline workflows, and deliver faster, more personalized policyholder experiences, all while ensuring compliance, privacy, and control.

- Engage policyholders seamlessly across voice and chat with consistent, natural conversations

- Automate routine processes such as claim status updates, policy verification, and premium reminders

- Empower agents with real-time AI insights, sentiment detection, and smart recommendations

- Ensure regulatory compliance and data privacy with secure, auditable AI workflows

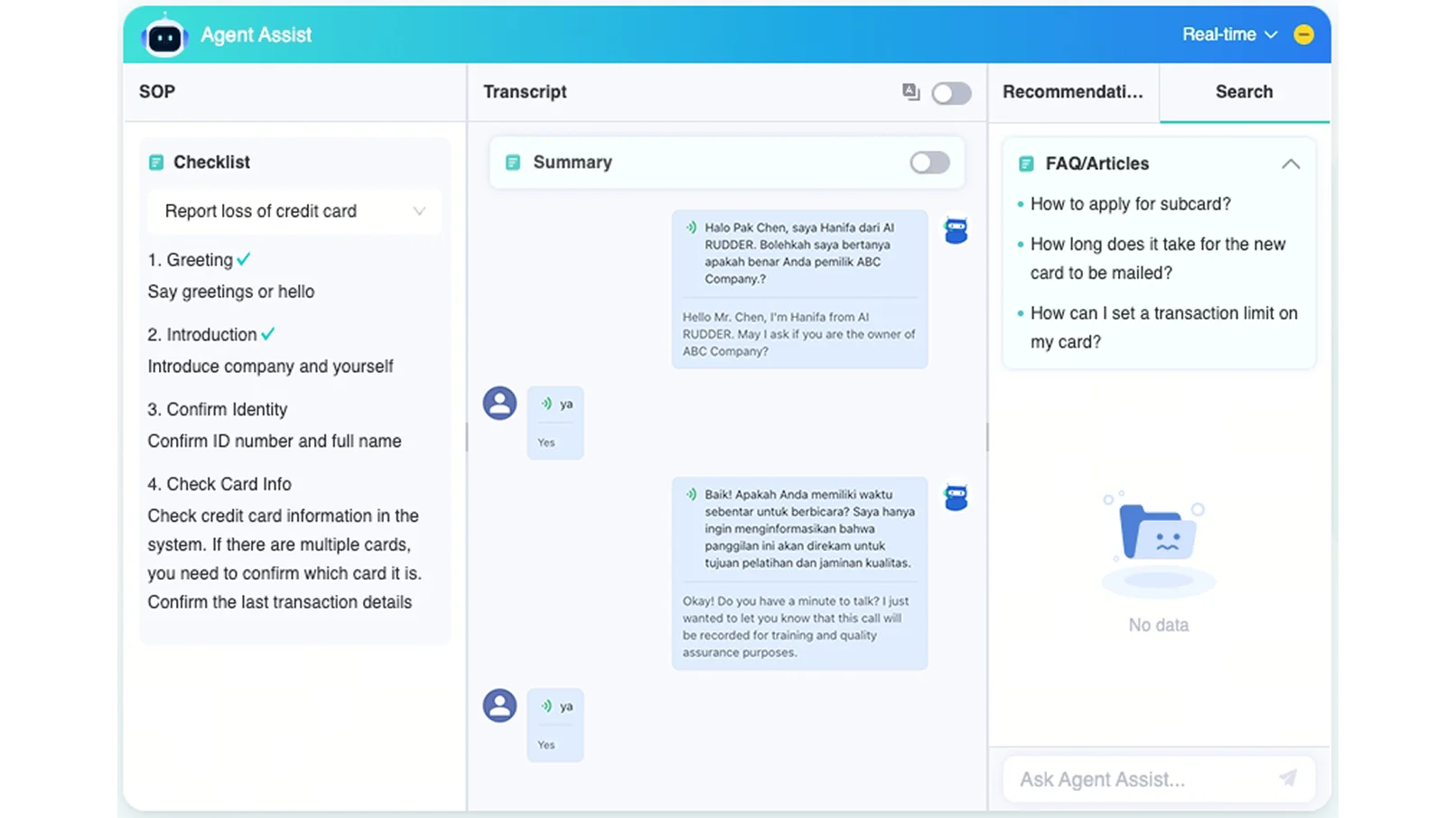

AI Copilot Agent as The Best Agent Assist for Your Team

AI Rudder's AI Contact Center (AICC) provides powerful Agent Assist capabilities that support your team during every customer interaction , whether through voice or chat. Agents receive real-time insights, suggested responses, instant knowledge retrieval, and compliance reminders, enabling them to work faster, smarter, and more accurately across all client workflows.

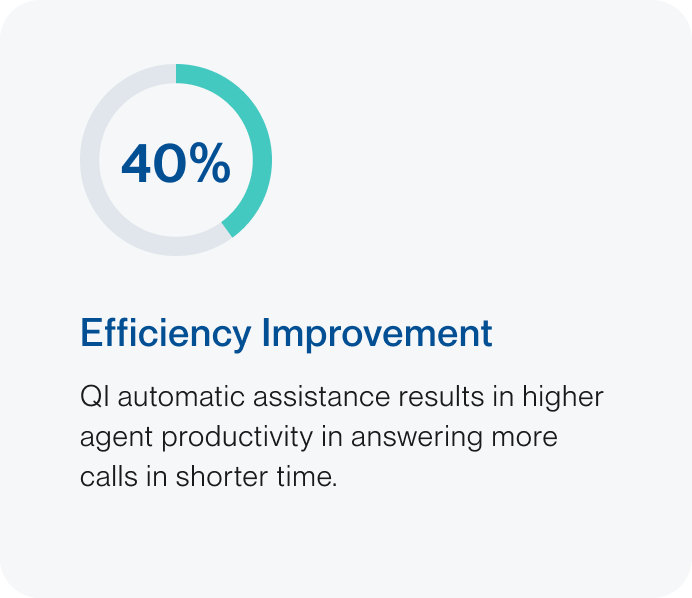

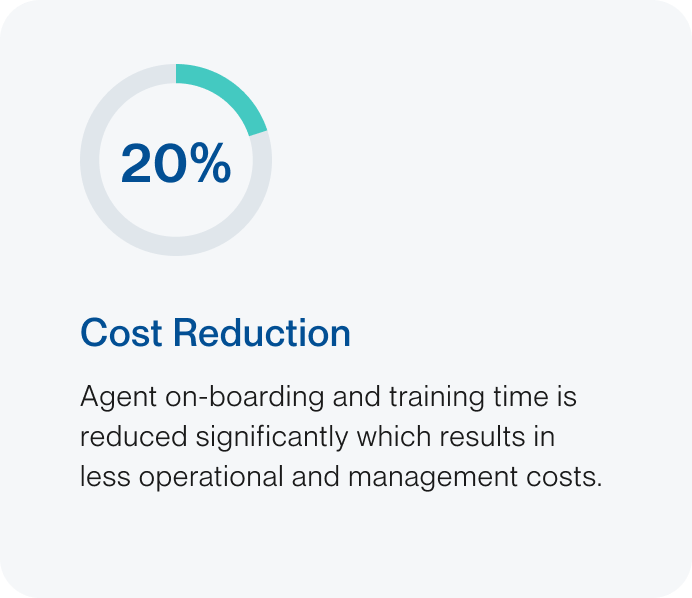

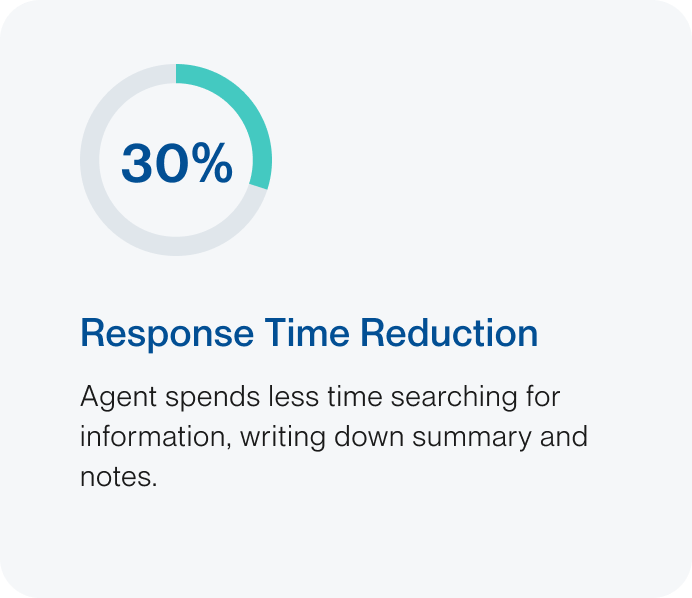

Key Benefits

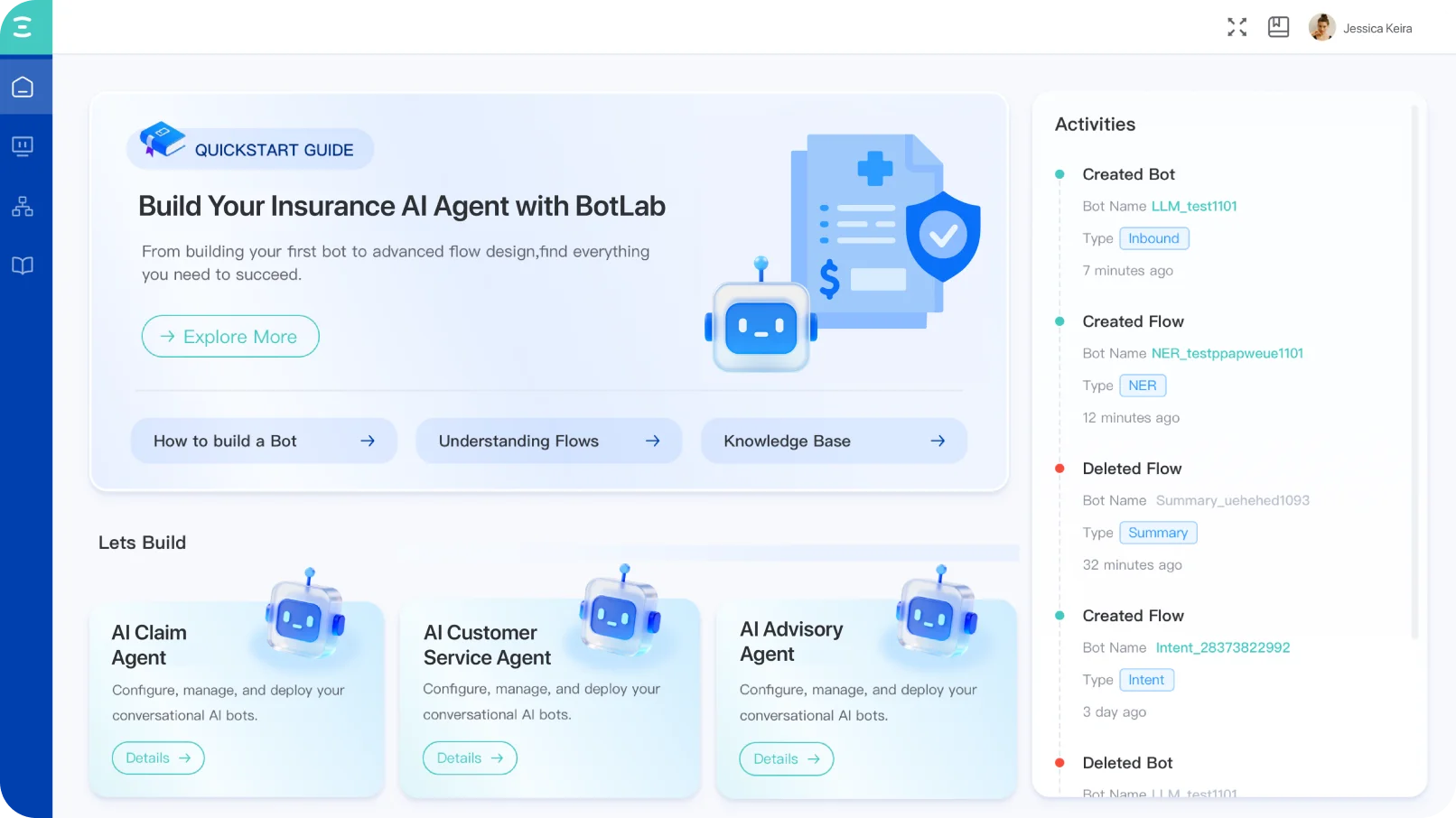

Empower Your Insurance Team to Build Its Own AI Agents

With AI Rudder BotLab, insurers can design, train, and deploy AI agents customized for their unique operations from policy onboarding and claims processing to customer service and renewal management. Build intelligent agents that understand insurance workflows, ensure regulatory compliance, and deliver secure, personalized customer experiences at scale all through a powerful no-code platform.

Explore BotLabAI Powered Insurance Customer Service

70%

Reduction in claim handling

65%

Lower inbound customer service workload

90%+

Automation rate for high-volume policyholder requests

5x Faster

Policyholder response & engagement speed

Other Use Cases

Info Checking

Welcoming Call

Telemarketing

Lead Qualification

Claim Status Update

Premium Renewal

Customer Service

Feedback Survey

Policy Upsell Campaign

Payment Collection

Omnichannel Engagement

Automatic Email Reply